In a tweet this week, the Welcoming Neighbors Network recommended that pro-housing advocates keep supply-and-demand arguments in their back pockets and emphasize simpler housing composition arguments:

This advice makes an economist’s mind race. We know, after all, that supply and demand work. But we’re not so sure about composition changes. If “affordability” is achieved by building units that people don’t want (in bad locations, too small, lacking valued attributes), then the price-per-unit can be low without actually benefiting people on their own terms. Even if existing homes are bigger than many people want, at least some of the price decline from building smaller homes is the “you get what you pay for” effect.

(Incidentally, this is the opposite concern from that held by econ-skeptics concerned about gentrification: they worry that new housing will be too good or that investment will upscale neighborhoods. This inverts the trope that economists “only care about money”.)

A few days later, a Maryland state senator asked me that very supply-and-demand question: “What’s the evidence that large-scale upzoning leads to affordability?” This is a tough question. First, large-scale upzonings are very scarce. Second, even if one occurs, it’s not in an experimental vacuum.

Three kinds of affordability

Let’s specify that an upzoning likely promotes affordability in three ways:

- Supply and demand

- You get what you pay for

- Only pay for what you want

The first channel is obvious – it explains why Cleveland is cheaper than Boston. The second source of affordability is valuable for people at risk of homelessness, but doesn’t make most people better off. The third source – what WNN recommends advocates emphasize – is that many regulations require people to pay for more housing (or pricey attributes) that they don’t want.

In a lot of cases, the last two effects will go together. Suppose a regulation forces me to pay for covered parking. I value the garage at $10,000, but it actually adds $30,000 to my home’s cost. Repealing it would save me $10k via “you get what you pay for” and $20k via “only pay for what you want.”

In my own research on Houston and Dallas minimum lot sizes this is exactly what I find: people value additional yard space, but not by as much as they’re paying for it.

Facing these questions, I was pleased to find that University of Michigan Ph.D. candidate Mike Mei had posted his job market paper – one of the few rigorous analyses that gets right to the heart of WNN’s advice and the senator’s question.

Finding an experiment in Houston

Houston’s choice to reduce minimum lot sizes to 1,400 square feet in 1999 was not random, and there’s no “control Houston” in an alternate universe. So Mei uses a “synthetic control” method to argue that reducing minimum lot size also reduced the size of newly built homes.

Synthetic controls use a weighted average of a “donor pool” of similarly situated cities that tracked the “treated” city (i.e. Houston) before a policy change. Mei’s synthetic control is reasonably convincing, although it relies mostly on just three donors.

This is a very useful and direct result for those of us advocating for minimum lot size reductions: even though developers squeeze as much house as they can onto Houston’s small lots, those houses are still smaller than the alternative.

Affordability without supply effects

Mei could have tried the same synthetic method to measure the impact of Houston’s reform on new home prices. But that wouldn’t let us distinguish between the various sources of affordability.

Instead, Mei uses a model of household decisions, taking into account household income and size (i.e., number of people). Intuitively, bigger households need bigger houses. His model allows migration, has no limits on how many houses are built, and assumes away location preferences, which effectively shuts down supply-and-demand as a source of affordability. That lets him isolate the gains from the “only pay for what you want” channel.

(There’s another minor “reallocation” channel in his model, but it wouldn’t show up in an affordability calculation, so let’s set it aside.)

Figure 14(a) shows that, in the long run, the value of only paying for as much house as they want will benefit Houston households by between zero and $28,000, with generally higher values for lower-income households. The average benefit is $18,000, which is one-third of the median income at the time of the reform. Figure 14(b) shows that households of all sizes benefit, but the benefits are greatest for smaller households.

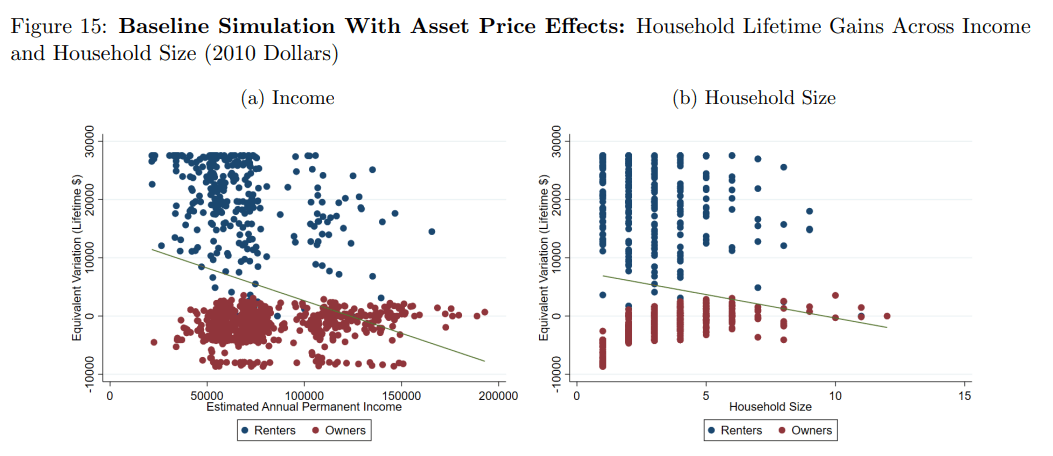

For Figure 15, Mei adds very simplified asset holdings, allowing households to rent housing and then become owners. If this simplification holds up, it shows that virtually all the benefits flow to people who were renters before the policy was introduced. Homeowners lose a little bit on average. The biggest losses are for owners who had small houses before the reform; those face the biggest increase in competition.

(It’s not clear to me why there’s a rigid ceiling at about $28,000 in gains – that’s probably an artifact of the model.)

Does supply even matter?

In my conversation with the Maryland senator, I confronted the hard truth that supply changes need to be very large to make a real dent in prices. If, as Albouy, Ehrlich, and Liu estimate, it takes a 3 percent increase in the housing stock to bring prices down 2 percent, then a major metropolitan area needs a massive increase in housing to make a real dent in rent.

Can we get there faster with composition effects? Let’s do a quick back of the envelope. First, assume population and housing stock would grow 10% each at baseline, with no resulting change in price.

- Supply only approach: we add 40% to the housing stock without changing the mix of housing types. Result: 20% affordability gains.

- Composition-only approach: we add 10% to the housing stock, but with the average price just 50% as high as the norm. Result: 5% affordability gains from lowering average price.

- Mixed approach: we add 25% to the housing stock, with the average prices 75% as high as the norm. Result: 15% affordability gain (10% from supply, 5% from lowering average price).

How realistic are any of these scenarios? I’m not sure. But my takeaway is that supply remains the primary avenue for broad-based affordability gains. But the “you get what you pay for” and “only pay for what you want” channels are far more important for the affordability of a particular new housing unit.