The Urban Economics Association conference is always creative and constructive. Here are a few notes I wrote down, with apologies to the vast majority of researchers who presented work there which I didn’t see.

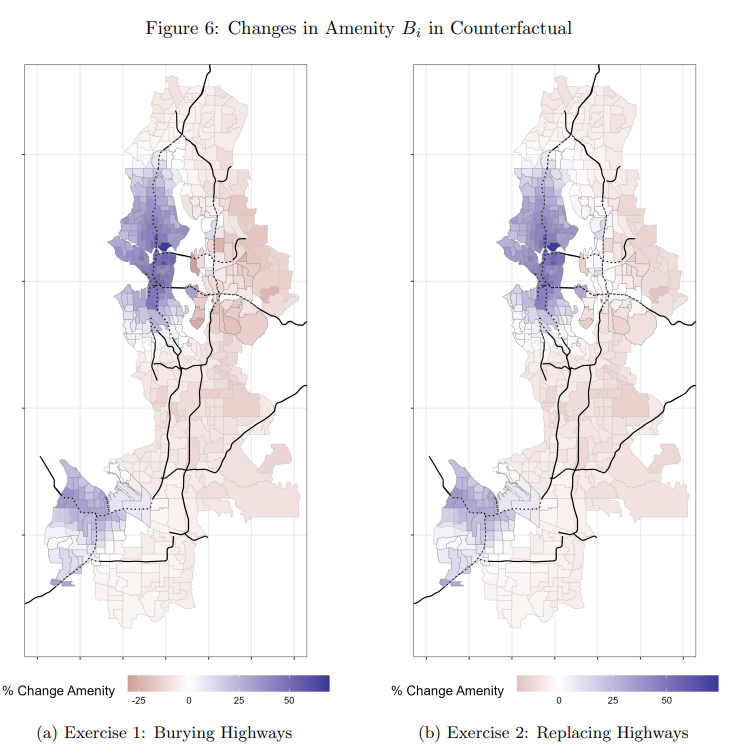

Alice Wang showed the most convincing evidence I’ve read on net costs of urban highways, using Seattle data. Smartphone data reveals that people avoid trips that either cross or use a highway. She estimates that replacing highways with surface roads would increase welfare by a massive 9%. Most of the gain is from improved access to urban destinations. But the suburbs would be a bit worse off. (One weakness: she doesn’t reckon with capacity constraints, so she’s probably missing low on the traffic costs).

Interestingly, burying the highways has basically the same result. That’s because the suburbs’ loss is mostly a function of the redistribution of businesses.

Railroads and highways have equally large effects in terms of neighborhood fragmentation (Vikram Maheshri & Kenneth Whaley).

Can we integrate these types of barriers into spatial social science? Evan Mast has built a new neighborhood/district geography that usually lines up with highways, rails, and rivers. But the basis for his new geography isn’t trips or maps, it’s moves. I didn’t realize many people move within a neighborhood, but it’s apparently quite common.

Seth Chizeck won the student prize for research showing that free transit vouchers didn’t help outcomes for beneficiaries much.

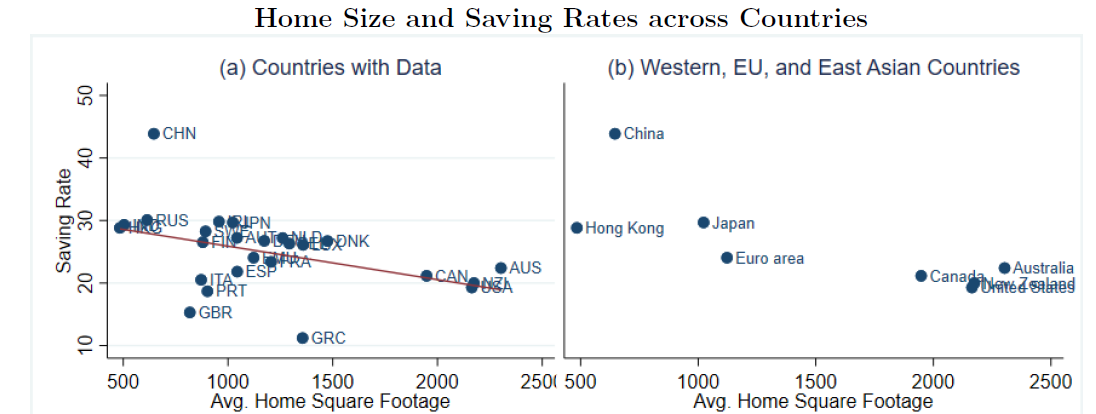

Urbanites save more of their money than suburbanites with equal incomes and demographic profiles. Daniel Murphy showed that city dwellers spend more on housing and eating out, but so much less on durable goods, maintenance, and utilities that they end up with a higher rate of savings. One possible explanation is that suburbanites own more land, which is a form of savings. But that doesn’t explain why urban renters save more than similar suburban renters.

Murphy’s explanation is home size, which correlates with savings rates across countries…

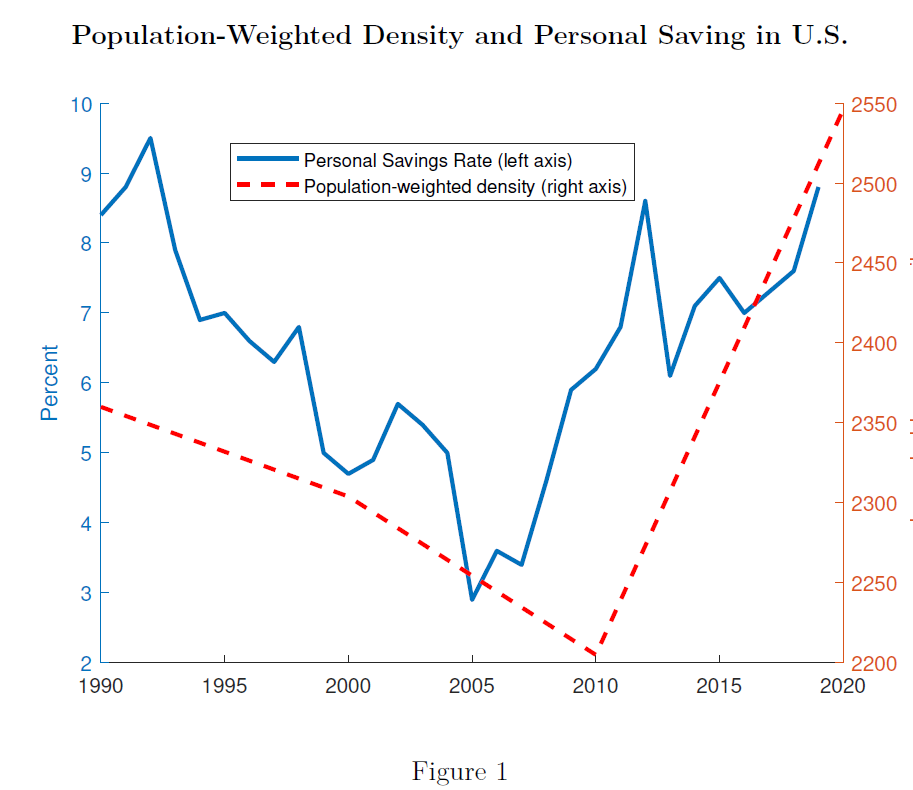

…and across time:

I will confess I had no idea that U.S. density had grown so much from 2010-2020.

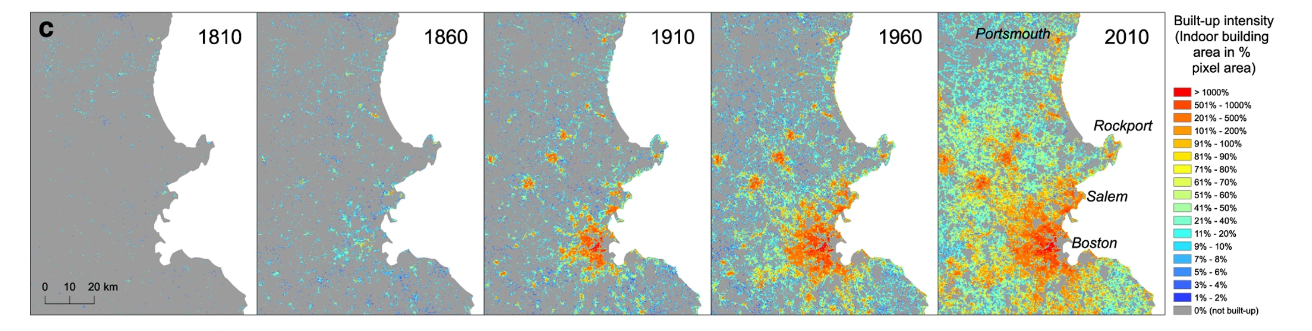

HISDAC-US is an impressive dataset. It provides an estimate of built-up density nationwide at a 250 meter grid from 1810-2015, based on Zillow’s ZTRAX records. The estimates are from work by Stefan Leyk & Johannes Uhl.

Texas counties that lost more soldiers in the Civil War had more urbanization from 1870-1900. (Phil Hoxie and Beatrice Lee).

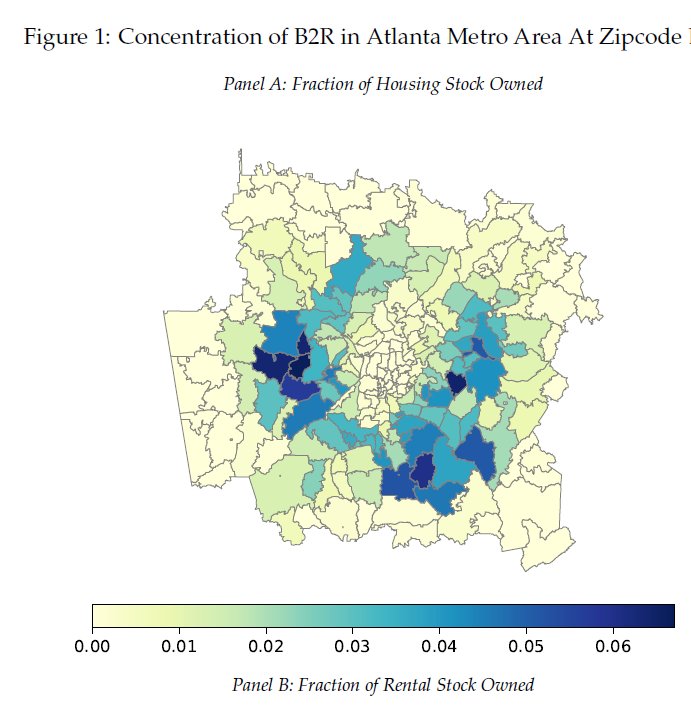

Joshua Coven looks at the entry of institutional investors into Georgia’s housing market. They crowd out small investors, induce more construction, and decrease homeownership. The result is slightly higher prices, slightly lower rents, and more diversity in single-family neighborhoods.

In Colorado, water impact fees are a significant cost attached to every new home. Benji Edelstein showed how a shift from one-size-fits-all pricing to contextual pricing changed construction patterns. This research (not public yet) is well-timed: the Supreme Court’s Sheetz decision will make it hard to sustain flat pricing models when better data is readily available.

Raheem Chaudhry and Amanda Eng study children who grow up in NYCHA public housing – the largest and among the best-run in America. Children who move into NYCHA projects are more often than not moving from a worse neighborhood. And among children who live in NYCHA, those with more years are better off as adults.

Hector Blanco and Noémie Sportiche investigate Massachusetts’ “Chapter 40B” housing law, which allows mixed-income developments to bypass local zoning (after a tortuous process). Hector’s presentation interpreted the data in a YIMBY-friendly way: for most houses around most 40B sites, there is no measurable effect on prices or migration.

But you could flip it around: there is a large and significant loss of value for the immediate neighbors (up to 0.1 mile) of large 40B developments. And it makes renters, at least, more likely to move away.

By contrast, Joe Gyourko and Sean McCulloch reported a strong “Distaste for Density” using bordering municipalities (here’s an earlier version). Numerically, the distaste for neighbors’ density might be comparable to what Blanco and Sportiche found. But the authors framed it in the opposite way.

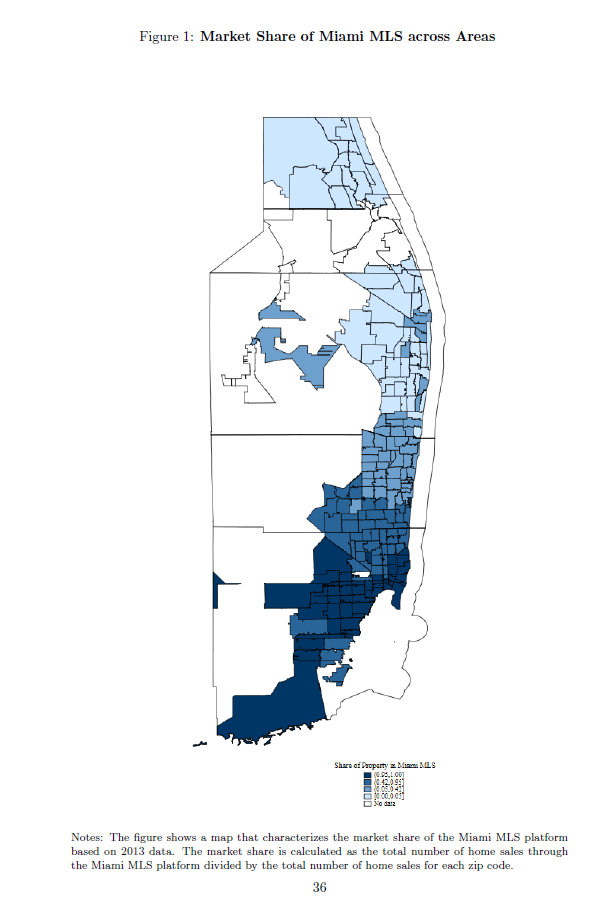

Each real estate listing belongs to one Multiple Listing Service (MLS) or another, sometimes with overlapping territory. When a sharing agreement between the Miami and Beaches MLS’s broke down, homes and buyers matched more slowly and prices fell. (Walter D’Lima presented this multi-author paper).

Rebecca Diamond’s keynote was a reminder that modeling choices matter. She thinks of permit process as a fixed cost that doesn’t vary with project size, an approach which yields predictably meh results.

Gordon Hanson’s keynote dealt with place-based policies. The most salient takeaway is that non-place-based policies, like Social Security and Medicaid, are more targeted to the poorest, neediest regions than the explicitly placed-based policies like tax incentives.

Urban economics is a rapidly growing discipline. Top students who wouldn’t have given it a thought twenty years ago are flooding into the discipline to take advantage of new data, powerful computers, and the gnarly-but-solvable public policy questions that 21st century cities present.